SMC Insights

Renter’s market

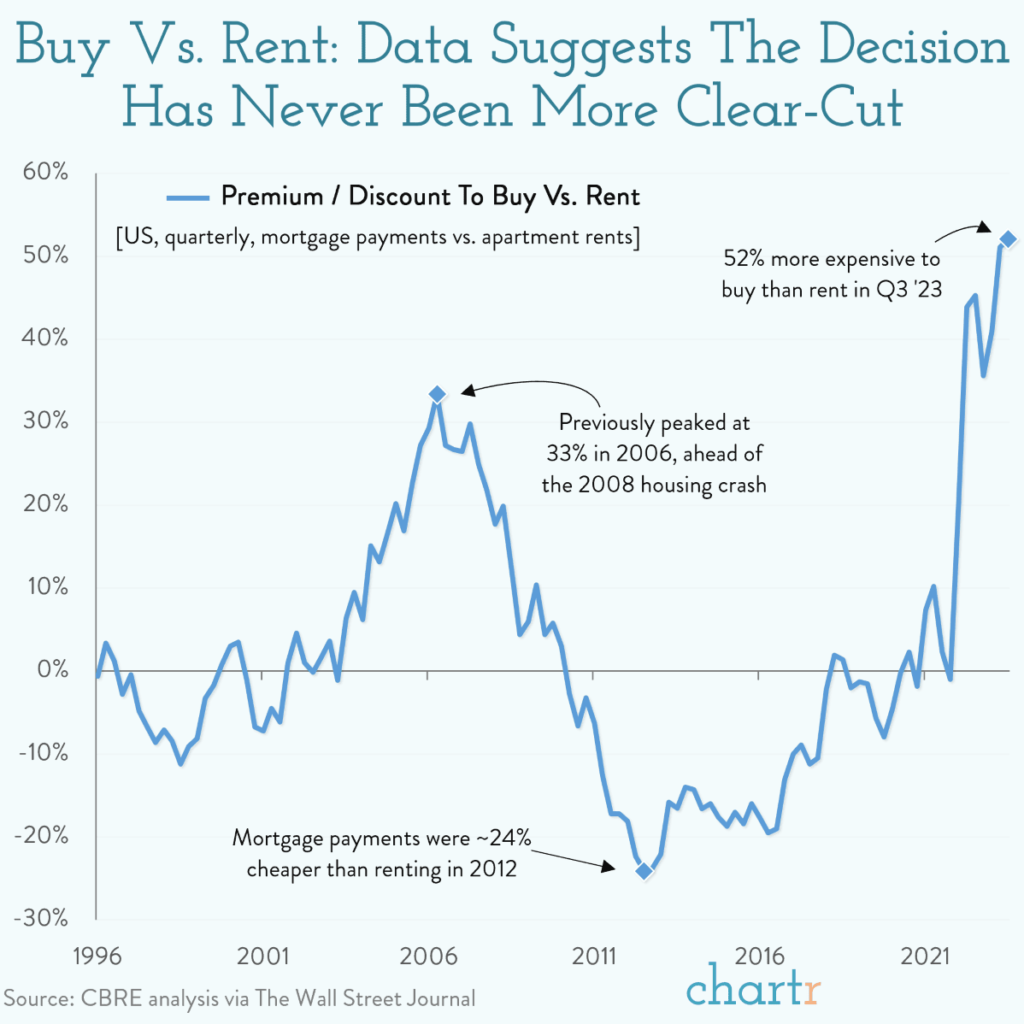

For Americans looking to get a foot on the property ladder, buying has perhaps never made less financial sense: CBRE analysis, cited by the WSJ, suggests that average new monthly mortgage payments are now 52% more expensive than typical rent on an apartment in the US. This disparity is now the most pronounced it’s been across the 27-year span of CBRE’s research.

Unreal estate

Various factors have coalesced in recent years to make the concept of buying a house, for many people at least, something of a pipe dream. The new analysis adds to the evidence that housing is at or near “peak unaffordability”, as steep prices, low inventory, and still-rising mortgage rates keep bidders at bay.

Theory would suggest that rents and house prices should move roughly in line, but the real world is rarely so neat and tidy. Indeed, CBRE’s analysis suggests that buying was the “value option” for much of the 2010s — a period that must feel far away for the 51% of non-home-owning Americans who fear they’ll never afford that first purchase.

Where we go from here depends on your perspective: either rents are about to soar to catch up, or house prices could be set to drop.

Michael Barrett

For generations, we have been asking ourselves, what makes a house a home? A house is the physical structure that provides four walls, warmth, furniture, plumbing, heat, electricity, and internet. A home gives much more, offering comfort, security and a sense of safety. A home is filled with love, personality, and life experiences. For most, when we buy a house, it comes without personal history. Only with time, a house transforms into a home filled with memories, family and friends.

SNH Habitat for Humanity helps to create homes. They provide a vast support system before and after moving in. During the purchase process they provide a supportive network and the financial tools for families to become and stay financially independent.

SMC Management Corporation is an apartment development and ownership business in Eastern Massachusetts, Rhode Island and especially Southern New Hampshire. We create houses, but CP Management, based in Exeter, NH manages our communities and creates a home for residents. We routinely receive letters of praise from residents complimenting the friendly staff. Much like SNH Habitat, CP makes our apartments a home for residents from the start.

CP ensures new residents easily settle into their homes by connecting them to their neighbors with common interests, provides amenities on site and gives residents the feeling of connection. CP Management goes above and beyond to provide local personalized experience and support for all the residents’ needs. They are always present and available to assist.

CP Managements does a phenomenal job guaranteeing residents do not just find a house; like SENH Habitat for Humanity, by personalizing the experience, they create a home for each resident.

Michael Barrett

Two years ago I joined a fabulous networking group called ProVisors where I have met many highly competent “trusted advisor level” professionals. In one of the group meetings about a year ago, I participated in a group exercise on verbal branding. I became intrigued with the concept of messaging and how little time we in have, in this day and age, to articulate our message and to differentiate ourselves from others in our respective businesses.

Recently, through one of our investors, I met a corporate consultant, Stephen Melanson www.melansonconsulting.com, who teaches “Differentiation and Game-changing Simplicity”. Over lunch, Stephen emphasized an extremely critical point – people don’t remember much of what you tell them at all. They only remember a small handful of things that stick out in their minds. Therefore, we all need to communicate our differentiators in 5 seconds or less..!!!

I immediately set off to define our key differentiator(s) at SMC. My conclusion: “SMC reports and pays its investors monthly”. You will see this mentioned throughout our website and our literature. I like to call it “mailbox income”.

I recently explained this to Steve Chapman, our Managing Partner. He responded, “don’t forget that investors and their advisors also love the fact we always put assets into our partnerships “at cost”, taking no money out up front, subordinating our interests to theirs.”

Michael Barrett

“Not now, I own too much real estate” is a statement we hear often from investors who own multiple homes around the world. While second, third and fourth homes most certainly are real estate, they are a completely different asset class from the real estate we purchase and develop on behalf of our investors. Like boats, homes are consumers of income. Direct investments in multifamily residential real estate are generators of income.

Recently, an investor announced to me that he plans to sell his $4MM home and he and his wife plan on investing the proceeds into income producing real estate. Smart move. Let’s do some simple math on their $4MM house:

| Annual maintenance and capex (2%) | ($80,000) |

| Property taxes | ($35,000) |

| Utilities, etc. | ($12,000) |

| Total annual cost of home ownership | ($127,000) |

Sell house and invest the $4MM in equity at an annual 9% current yield on the $4MM. Use our average IRR of 14% and the $360,000 becomes $560,000!!

| Sell house and invest the $4MM in equity at an annual 9% current yield | $360,000 |

| Rent luxury townhouse in same town @$7,000/mo | ($86,000) |

| Utilities, etc. | ($12,000) |

| Total | $262,000 |

| Annual cash flow swing with only 9% current. | $389,000 |

Without taking into consideration modest appreciation, total IRR and tax benefits, that’s a cash flow swing of + $389,000 per year, over $25,000 a month. That’s what I call owning too much real estate!

Michael Barrett

Source: www.thestreet.com

Many investors choose REITS over direct ownership because of liquidity, but they give up tax benefits and returns in doing so. Curious about the basics, I did a simple analysis on the performance of the top ten rated REITS by thestreet.com and below are a few of my observations:

- Going-in valuation of the top 10 REITS average a PE of 34 which translates to a 3.7% yield to equity. Going-in valuation of direct investments typically average a 7% or greater yield to equity.

- Average annual dividend yield for the top 10 REITS for the last 5 years was 5.34%. Average current annual distributions for direct investments typically average around 8%.

- Average total returns (IRR) for the top 10 REITS for the last 5 years was 9.14%. Average IRR for direct private equity real estate investments averages 12% industry-wide and ours is just over 14%.

- Dividends and profits from REITS are taxed by the IRS using ordinary income tax rates. Direct investment limited partnership income is taxed through K-1 tax reporting, with cash distributions sheltered by depreciation and tax losses due to new construction and/or renovation. Profits are taxed, for the most part, at long term capital gains rates. Tax benefits of direct ownership can add as much as 4% to annual returns.

Of course, past performance does not guarantee future results.

Michael Barrett

While spinning at the gym recently, I observed a commercial on the TV for Reese’s Peanut Butter Cups that said: “Same as last year, no changes, nothing new, perfect.” I was struck by the ad because it reminded me of the consistent nature of what we do year in and year out at SMC. While not perfect, we consistently maintain a culture of discipline, patience and diligence while executing, delivering results, reporting and distributing cash flow to our investors and partners.

SMC is what one might refer to as a “downstream developer” purchasing assets that have most often been painstakingly planned and permitted by highly qualified professionals who have run out of money, experienced bad market timing or both. Stephen M. Chapman, our Managing Partner can often be heard saying, “We are not creative. We acquire great projects from others that have taken the ball down the field as far as they could. Our business template enables us to forecast start dates, cash distributions and eventual dispositions.”

Michael Barrett

Today’s lending environment:

Thoughts on real estate investing, monthly income distributions, and multi-family real estate investment. A typical residential mortgage now requires 25% to 30% money down with very strict credit requirements. This makes buying tougher and barriers of entry AND exit much higher than just a few years ago. Recently, I spoke with a residential real estate broker who said her appraisal business was out-performing her brokerage business because banks are now requiring three appraisals on many new loans.

A significant demographic shift:

More people are looking to rent a Class A apartment as a lifestyle choice as an alternative to purchasing a house or condominium. Over the last few decades our thinking about career and how we live our lives has changed. Our parents taught us to buy a home, have a successful career, pay off the mortgage, save money, and eventually retire with a paid off home and a nest egg. Today’s workforce is much more mobile and it’s no longer common to remain with a single company in the same city for an entire career. To accumulate wealth, many are now choosing diversified investment strategies through financial advisors and family offices rather than home ownership. Those investment professionals are recommending investment in multifamily real estate through a quality operator/developeand converting ordinary income into long term capital gainsr (like SMC) as a hedge against the volatile stock market.

On the other end of this demographic shift:

An equally important driver are the aging Baby Boomers who are downsizing, selling their homes and moving to locations with amenities similar to those desired by Millennials and Gen Y, but with convenient health care. For these reasons, a growing and very successful segment of our population is choosing to rent rather than own.

On the Greater Boston multi-family real estate market:

The metro Boston Area continues to rank within the top three multi-family markets nationally, with an annual compounded growth rate of almost 5% since 1995. During that same period, the average annual vacancy rate in Boston has been just under 4%.”